Where Do We Park the Cash?

Once my wife and I got rolling with our savings

plan, as some of you have been following along in my previous

posts, funds started to accumulate pretty quickly.

Our goal was to live on two paychecks a month, and save $500 monthly from those

two checks. This also meant that on the two occasions in which I received a

third paycheck in one month (I get 26 checks annually), we would save that

entire check. This would allow us to save just over $12,000 per year.

We started down this savings path just over a

year ago, in July of 2018. We had a little bit of savings to start with

(around $6,000), and I received a vacation time payout from my previous job. We

also enjoyed seeing our money accumulate and became pretty aggressive with

transferring funds to savings whenever we had a little bit extra to transfer

over, even if it was just $50. I had the opportunity to teach as an adjunct

instructor at a local community college, which I treated as a side hustle and

transferred 100% of those funds towards our savings. A little over a year

later, our little fund has risen to about $35,000.

As I have made pretty clear on this blog, our

goal is to save towards buying an investment property. Meanwhile, we had a

decision to make. Where do we park the money? Because we were actively looking

at real estate, I didn’t have the option of going to a CD, as I needed to

remain pretty liquid. The interest rates for savings accounts are a joke,

paying anywhere from .05% to .25%. I had a long stint in my yesteryears in

which I was investing/trading, so I decided to focus on what I thought were

“safe” stocks to park our money until we had an offer accepted.

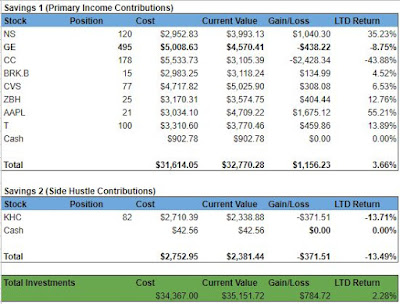

Here’s how that portfolio has worked out:

As you can see, we did a little better than the

banks by earning 2.28% on our investments, but definitely not enough to justify

the risk we took by being in this roller coaster of a market over the past few

months (I still have nightmares about December, 2018). We recently got very

close to having an offer accepted on a house, and I jumped the gun and cashed

out on all positions except KHC and GE, which I believe still have some ground to

gain in the next few months.

In a future post, I will discuss how I make my decisions to invest in these individual stocks by using simple fundamental analysis.

So, what do you think about what we have been

doing? What would you have done instead with the money while you wait to get an

offer accepted on an investment property?

Comments

Post a Comment