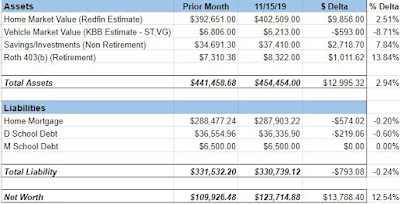

Net Worth Report #2

I update my net worth tracker frequently, and

will periodically post it here. My initial goal is to increase our net worth to

$1M, and we are currently a long way from that goal. The growth since my last

update (one month ago) has been pretty remarkable at

+12.5%, with the value of our primary residence rising significantly. Here’s a

quick synopsis of each category:

Assets:

Home Market Value: I use Redfin to track this, and their estimate of our home’s value

is that it is worth $402,509, or +$9.9K since last month. This was a nice

surprise since the home’s estimated value had been stuck near $390,000 for a

while. The rise is likely due to two neighbors recently selling their homes for

north of $400,000.

Vehicle Market Value: I own a 2015 Sentra, and I expect the valuation of the car to

drop off monthly as that is what happens to most vehicles. This month the car

lost -$593.00 of its value according to Kelly’s Blue Book.

Savings/Investments (Non-Retirement): Our savings/investment Ameritrade accounts saw an impressive 8%

jump since October, 2019, even with us having 75% of our money in cash at the

moment after selling our stocks to buy a real estate investment that eventually

fell

through. The three stock

positions we held (General Electric, Kraft Heinz, and Chemours) saw significant

valuation gains over the last month.We also continued our regular bi-weekly

contributions of $300, which helped arrive at the $2.7K rise on the savings

account.

Roth 403(b) (Retirement): A 403(b) account is the public employee’s version of a 401(k). I make

a nominal contribution of $125 per paycheck towards this account, and it

currently has $8.3K and saw an impressive 14% jump from last month.

Total Assets Growth: $13K - 3%

Liabilities:

Home Mortgage: We do not pay extra towards our mortgage (due to a low 4% loan

rate), so this liability will see very minimal drops monthly. It lowered by our

monthly principal pay-down amount of $574.

D School Debt:

We’re currently not paying extra towards my students loans either, so the drop

here since last month was only $219. I only graduated recently and am paying

for my MBA loans. They were consolidated at 5% over 10 years.

M School Debt: This

is my wife’s school debt. She only has a few thousand dollars left at

2.25%.

Net Change: Our net worth grew almost $14,000

since last month, or 12.5%.

Comments

Post a Comment