Avoiding Greed

This is how greed made me lose $15,000 day

trading.

If you’ve been following my blog, then I hope it

has been very clear that I am very proud of the personal finance progress my

wife and I have made. About a decade ago I was facing deportation, and was

given the gift of being able to stay in this great country. Before my

immigration troubles, I had dabbled in day trading stocks with some

level of success, and was forced to

liquidate my account to make ends meet as my immigration case lingered for

about three years.

When I was given authorization to stay and work

in the US, I got busy trying to make up for lost time. While I was trying very

hard to make some money quick, I lacked the foundational understanding of

personal finance and budgeting. I didn’t even have specific goals other than to

“make as much money as possible as quickly as possible.” In my mind, a lack of

goals and a lack of foundational personal finance understanding puts you at

risk for bad decision-making. That was exactly what happened to me.

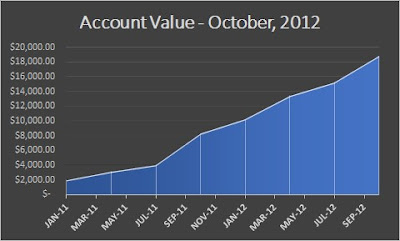

In 2011, I was able to restart my Ameritrade

trading account with a $2,000 deposit. I had maintained an eye in the markets,

and already “knew what I was doing,” so I hit the ground running and it did not

take long before I hit a hot streak and the account started growing. I was

attending community college and managing my family’s small business, and this

time I was armed with the ability to trade on my cell phone, so I was trading

very frequently (but this time I was restricted by “pattern day trading

rules”).

My trading strategy was simple. Utilize

technical analysis to identify entry points and areas of support, and put my

entire account into the position. I sometimes owned stocks for less than five

minutes. The risk exposure was huge, but I kept winning, so all was well for a

couple of years. I remember walking around York, Maine during my “mini

honeymoon” in October 2012 and, my account on that day was at an all-time high

of over $18,000. Here’s what my account growth had looked like until then:

Sounds, awesome right? I was certain I was going

to be the next Tim Sykes, perhaps even bigger. All I needed to do was change nothing about

my strategy. I was going to cross over $25,000, get over the pattern day

trading restrictions, get some leverage from Ameritrade, and probably make

millions!

Those were very greedy thoughts. The money had

come so easily that I did not appreciate it at all. My first trade after

hitting +$18,000 was a $3,000 loss. I started chasing that loss, and bad

decisions started snowballing. When my first child was born in August, 2015, my

account looked like this:

Needless to say, I am no Tim Sykes. I eliminated

my trading account that August to help finance the purchase of our first home.

Although I own stocks again

today, I never placed a day trade again, and I have a

significantly more conservative investment approach today.

Avoid What I Did:

This story outlines my biggest money mistake. I

have many regrets about how I handled this situation, and would avoid this again

by doing the following:

- Have goals: I didn’t really have a clear

understanding of what I wanted to achieve with my trading account. This

made me too loose with my trading.

- Control risk: Once my account hit $5,000, I

should have never had more than $5K on one single trade. Putting all of my

money into trades gave me great results when I was winning, but the losses

were also too great when they started happening.

- Take a break: Once I started losing. I

should have walked away for a while. Instead, I increased my trades the

more I lost, which led me to eventually losing all of my winnings. When

you’re hot, keep going. When you’re losing consistently. Step away and

reevaluate your strategy.

- Be accountable to someone: I traded in a silo. My wife never knew what my account was up to. Had she known, she might have given me some thoughts that would have made me more conservative. One thing I like about Tim Sykes and his community is that they keep each other accountable. I think this is important for traders. I am trying to do this now with my personal finance goals. This blog is part of that accountability piece.

I miss my trading days, and might one day return

with a small percentage of my net worth. For now, I am enjoying my pursuit of

purchasing passive income-producing assets that will create generational wealth

for my family.

Comments

Post a Comment